- Sebi’s New Initiatives, Revitalised MF Lite Framework And ‘Specified Investment Funds’ Set To Propel Mutual Fund Penetration In India

- Stockpicking funds suffer record $450bn of outflows

- Is PHYSX a Strong Bond Fund Right Now?

- Best tax saving mutual funds or ELSS to invest in January 2025

- The 10 Best Fund Managers of 2024 and Their Stock Picks for 2025

Exchange-traded funds enjoyed another banner year in 2024. Strong markets and relentless inflows drove ETFs to new heights. For the first time, ETFs collected $1.1 trillion in new money, while assets swelled to more than $10 trillion. But underneath those headlines are several other important and emerging trends:

Bạn đang xem: 6 ETF Investing Predictions for 2025

- Bitcoin continued its tear, spurring record interest in freshly minted spot bitcoin ETFs.

- Spot ethereum ETFs also began trading, albeit to less fanfare.

- Fund providers piled on ETF share class filings. A verdict is expected in 2025.

- Active ETFs continued their ascent as asset managers jockey for position.

- Private market ETFs race toward reality.

- ETFs that can’t go down.

Those are just a few of the many notable ETF stories from 2024, and 2025 is sure to be filled with surprises. Just like this time last year, each member of Morningstar’s ETF research team offers their predictions for what ETF investors can expect in 2025.

In order from most likely to least likely, here are our 2025 predictions. (Scroll to the bottom of the page to see how our 2024 predictions fared.)

Prediction 1: Active ETFs Outnumber Passive ETFs

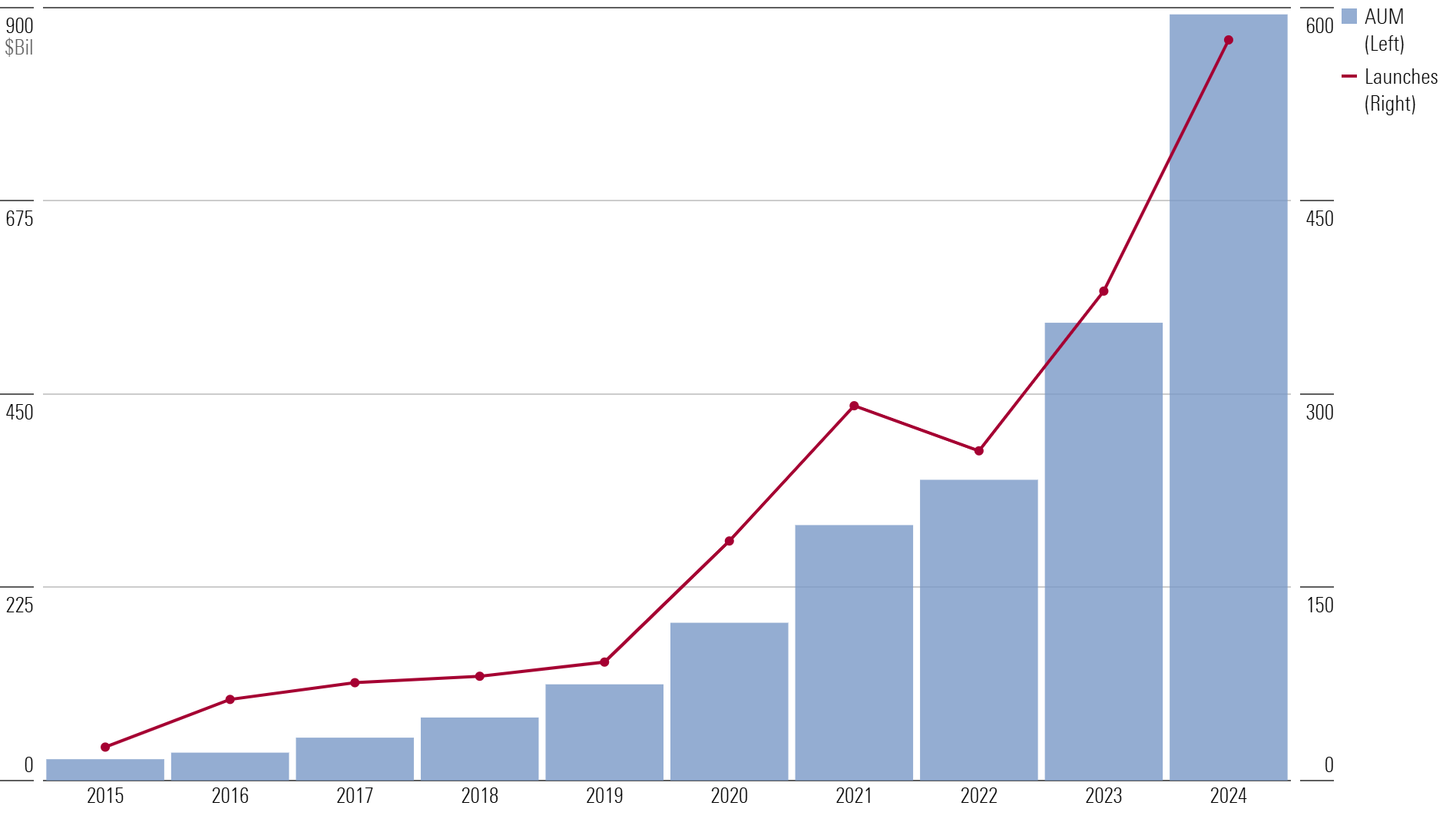

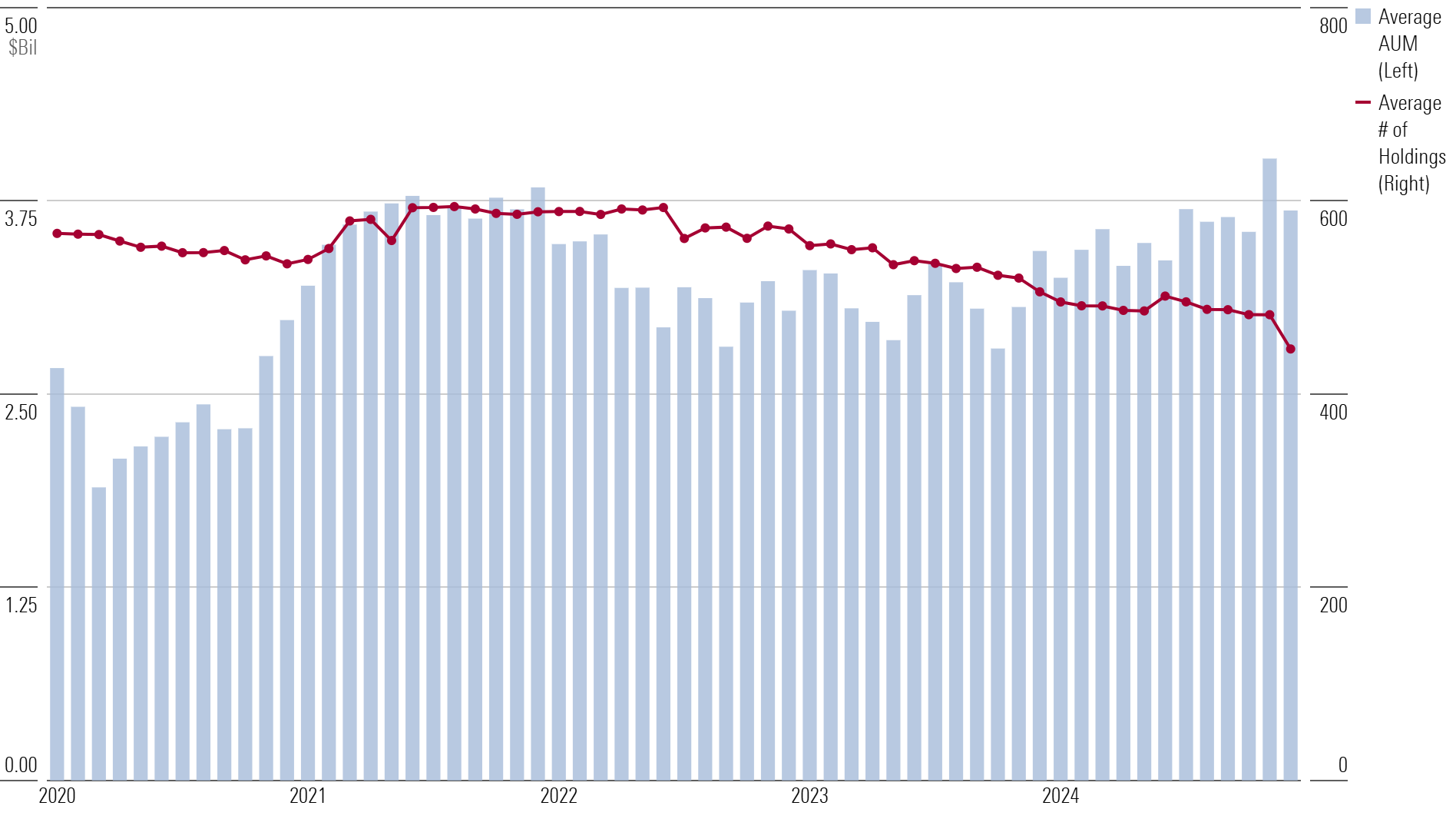

Historically, exchange-traded funds have focused on index strategies. While most ETF money remains tied up in index funds, actively managed ETFs have grown significantly over the past five years.

The SEC made it easier for ETFs to gain approval and permitted the widespread use of custom creation/redemption baskets in 2019. Custom baskets allow ETFs to buy or sell groups of securities that don’t exactly match what the ETF holds, giving active managers a new portfolio management tool and the flexibility to negotiate baskets with market makers. The result was lower trading costs and improved tax efficiency for ETFs and tight bid-ask spreads for ETF investors. Soon after, active ETFs flooded the market and have continued to grow in number.

The gap between the number of active and passive ETFs narrows with each passing year. Active ETFs added 424 more funds to their ranks than passive peers in 2024, further narrowing this gap. A continuation of the trend would mean passive ETFs’ 200-fund lead will be short-lived. I expect this changing of the guard to occur in 2025.

—Brendan McCann

Prediction 2: ETF Closures Remain High

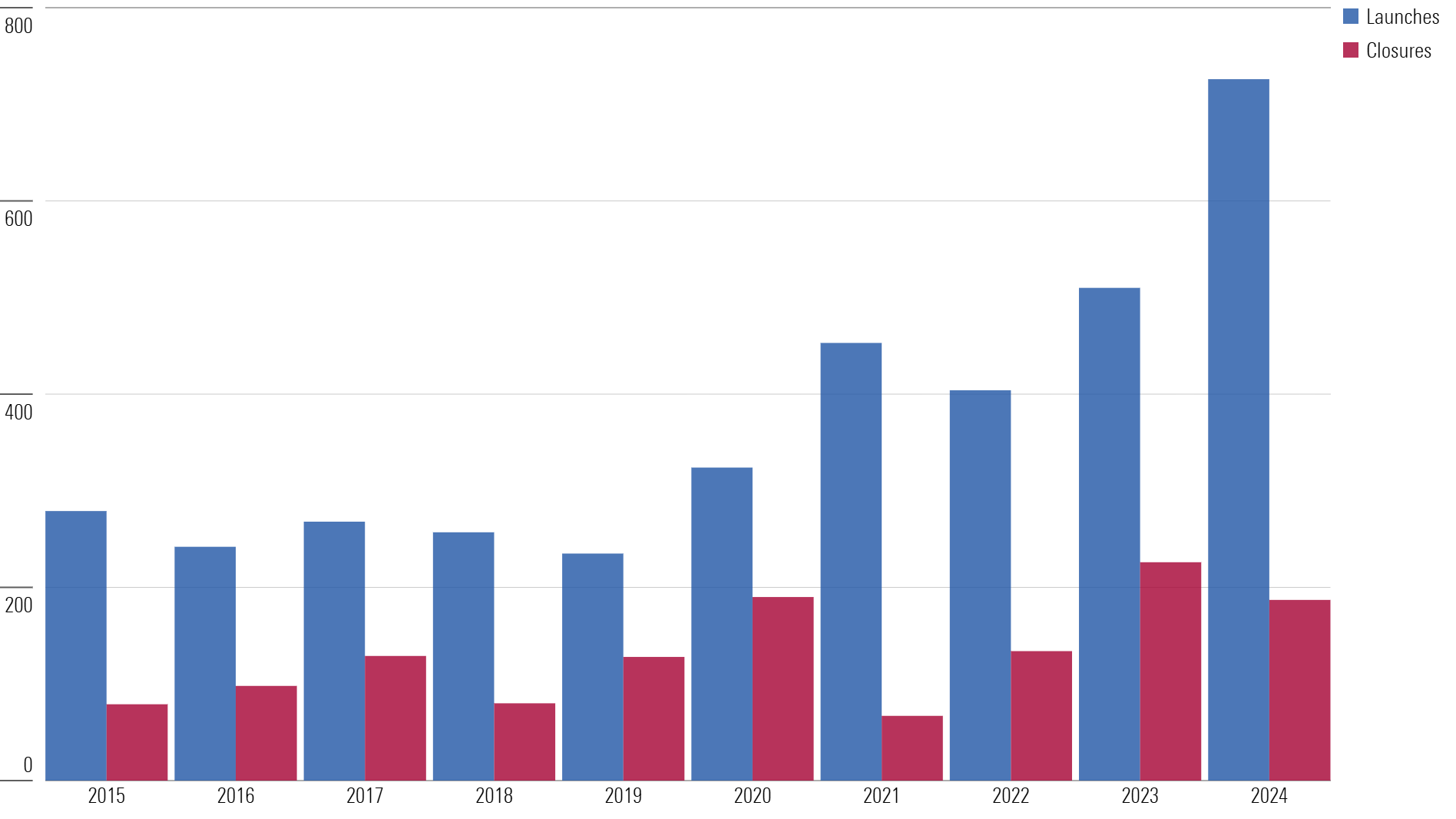

I’m doubling down on my prediction from last year: ETFs should continue to shut down at a high rate. I expect the number of closures to surpass their 2024 mark of 187. Closures were higher in just two other years: 2020 (190 closures) and 2023 (226 closures).

ETF providers launched a record 726 new ETFs in 2024. With few exceptions, these newly minted ETFs are novelties that are complex, risky, expensive, and won’t perform well over the long run. Investors don’t need most of them.

That means US exchanges are drowning in an ocean of ETFs. More than 3,900 traded on US exchanges at the end of 2024. Many of them qualify as walking dead. Around 1,100 had $50 million or less to their name, while more than 1,500 had less than $100 million. These ETFs are prime candidates to close shop. At a certain point, the costs of providing these ETFs outweigh the revenue they’re generating. Sooner or later, they’ll have to wave the white flag.

—Daniel Sotiroff

Prediction 3: Single-Stock ETFs Multiply

Anything and everything can be an ETF these days. Want double-leveraged MicroStrategy MSTR exposure? There’s an ETF for that. Covered calls on C3.ai AI stock? Sure, why not? Behind these inane ETFs is a wider trend: ETFs as a trading tool.

Single-stock ETFs are inappropriate for almost all investors. They’re not long-term investments and are instead trading tools that should be held for minutes or hours—if at all. One company’s stock determines the ETF’s performance by using derivatives of the stock to leverage, short, or squeeze more income out of it. Investors are growing more curious.

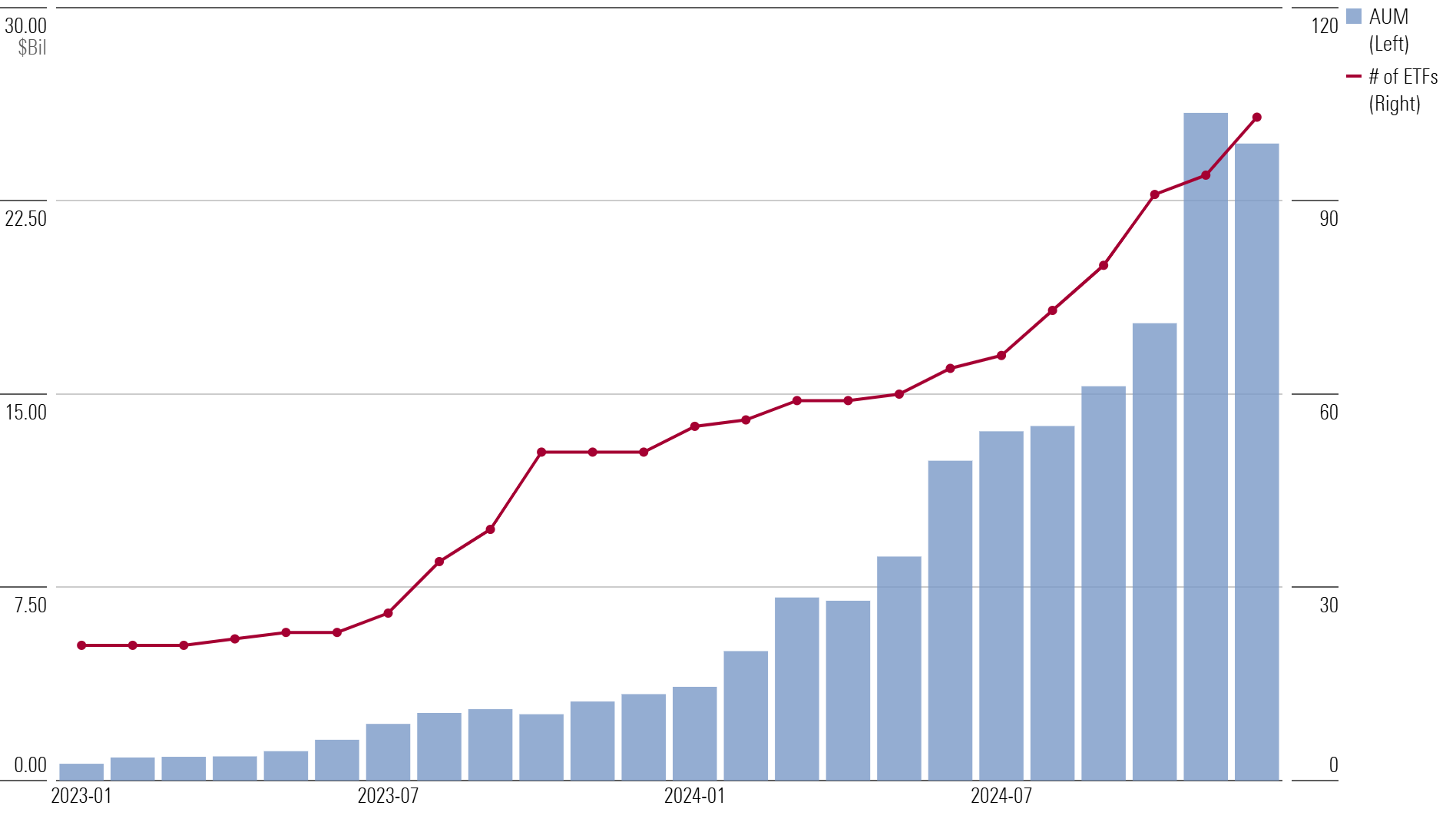

Single-stock ETFs package one or multiple options trades into an easy-to-buy product. Each single-stock ETF presents myriad nuanced risks. Still, they continue to propagate as asset managers latch onto these potentially profitable products. There were 103 single-stock ETFs available for purchase at 2024’s end. Up from 51 a year ago. Those linked to Nvidia NVDA and Tesla TSLA shares are by far the most popular.

Xem thêm : What Is an Index Fund? a Beginner’s Guide to Passive Investing

In a landscape dominated by low-cost issuers like Vanguard, scrappy competitors pounce at any remaining white space in a bid to capture market share. With thousands of stocks and almost infinite options combinations on each, I expect the number of single-stock ETFs to multiply in 2025 as smaller issuers fill the shelves. Few of these ETFs will achieve sustained success, but traders will be spoiled for choice.

—Zachary Evens

Prediction 4: Vanguard’s VOO Overtakes State Street’s SPY as World’s Largest ETF

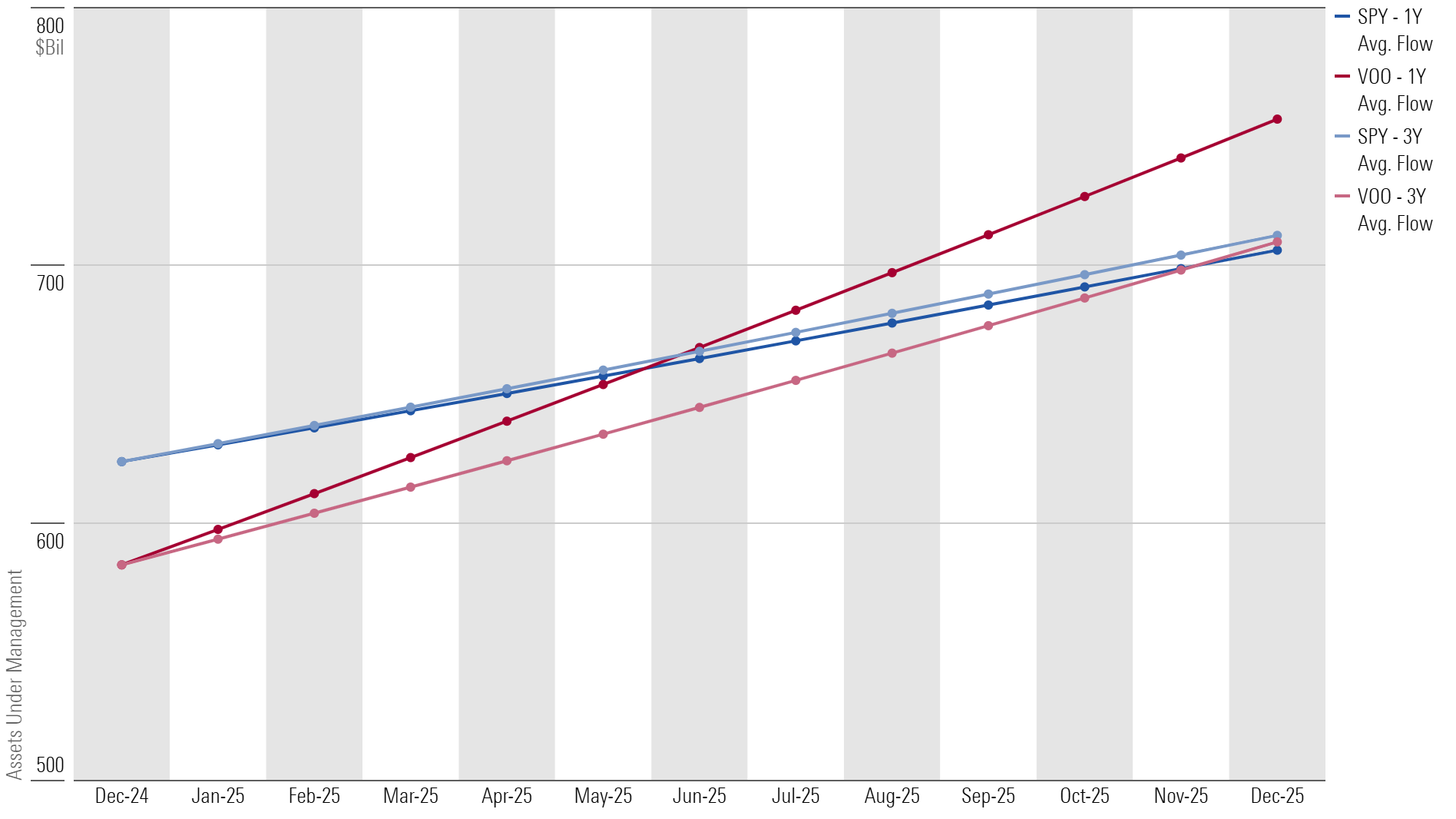

SPDR S&P 500 ETF Trust SPY has stood atop the ETF market since its inception in 1993. It remains by far the most heavily traded ETF in the world, but its lead in assets under management has faded in recent years. Strong market returns keep SPY in the pole position with $624 billion in net assets, a $40 billion lead over Vanguard S&P 500 ETF VOO at the end of 2024.

There’s only so much an S&P 500 index fund can do to earn an advantage over peers; SPY’s trust structure and higher fee are a disadvantage. An inability to participate in securities lending also removes incremental revenue for its investors. The result has been a 6-basis-point annualized disadvantage for SPY over the past decade, a small but unnecessary burden for investors to bear.

Persistent, strong inflows for VOO may finally erase SPY’s 17-year head start in 2025. This year, Vanguard’s challenger added a record $116 billion in new money—$96 billion more than SPY. Should it continue its torrid pace of inflows from 2024, VOO will become the largest ETF in the world during the summer. But if VOO reverts to its three-year average flows advantage—$40 billion—then SPY will keep its lead … for now. This will be a close race to watch in 2025.

—Bryan Armour

Prediction 5: ETF Share Classes Become Reality … But Stand-Alone Active ETFs Remain on Top

Firms have piled on ETF share class filings after Vanguard’s patent on the structure expired in 2023. But once approved, they might not be the lifeline many hoped they would be.

There are benefits to an ETF share class: It can shoulder some of the capital gains tax burden for the existing mutual fund, especially if it’s been bleeding assets. They’d also be cheaper to implement than launching a brand-new ETF. Still, stand-alone ETFs carry distinct advantages.

The tax benefit for a stand-alone ETF is immediate and not contingent on mutual fund performance or flows. In the ETF-as-a-share-class structure, the ETF vehicle must amass enough assets and inflows to shield the mutual fund from a capital gains distribution. This may take a while, especially if the mutual fund’s performance and flows lag.

Stand-alone ETFs can also better position themselves to handle the capacity issue of the ETF structure. ETFs can’t close their doors to new investors, so high-conviction strategies will likely remain a mutual fund or closed-end fund. Successful mutual fund managers can broaden investor reach and manage capacity by launching a stand-alone ETF that resembles but doesn’t copy their mutual fund. For them, an ETF share class could create more problems than it solves.

Last, advisors must act in the best interest of retail customers when making recommendations, under the SEC’s Regulation Best Interest. That typically means recommending the cheapest share class that the investor qualifies for. Introducing a cheaper ETF share class of a mutual fund may end up cannibalizing existing share classes.

—Lan Anh Tran

Prediction 6: ETFs’ Main Drawback Rears Its Head

ETFs cannot close to new investment—a drawback largely obscured by the myriad benefits that have resonated with investors. But the inability to turn away money will spell disaster for at least one ETF in 2025, generating headlines and forcing the market to reexamine where ETFs make sense. Call it the first fight of the honeymoon between ETFs and an investor base that’s fallen in love with them.

The amount of money a strategy can absorb without compromising performance varies based on its breadth, liquidity, and valuation. ETFs historically harbored broad index strategies that can absorb immense investments with ease. Now, they also host narrower strategies that must be lean to execute properly, like concentrated small-cap funds. That’s a risk when closing the ETF isn’t an option.

Problems here have already surfaced. Pacer US Small Cap Cash Cows 100 ETF CALF, an $8 billion ETF that owns more than 5% of shares for 30 portfolio holdings, ranked last of all small-value ETFs through 2024, losing 7.5% in a year when the Morningstar US Market Index gained 24%. ARK Innovation ETF ARKK had well-documented problems with capacity during its heyday.

My prediction is that 2025 will bring a higher-profile meltdown that awakens investors to this drawback. It won’t stop ETFs’ takeover of the US fund market, but it may slow the mutual-fund-to-ETF migration in categories that are sensitive to capacity.

—Ryan Jackson

ETF Investing Takeaways

The future is unknowable, so predicting it is impossible. Speculation is fun, though, and it makes investors take stock of possible outcomes.

These predictions are not intended to serve as an ETF doctrine or cause you to suddenly change course. They’re instead intended to highlight some areas, themes, or trends investors should be aware of going into 2025.

What plays out may rhyme with our predictions, but exact accuracy is unlikely. Take each with a grain of salt, but keep an eye out for topics and themes noted in each. You’ll be surprised what you might notice.

Morningstar’s 2024 ETF Predictions

Prediction 1: Active ETFs Become the Preferred Choice for Alpha-Seeking ETF Investors

Result: Inflows into active ETFs notched $293 billion in 2024, while strategic-beta ETFs collected $139 billion.

Prediction 2: ETF Closures Will Increase

Result: 187 ETFs shuttered in 2024, down from 2023’s 226 tally.

Prediction 3: Bond ETF Launches and Flows Accelerate, Led by Active ETFs

Result: Active bond ETFs collected $111 billion of new money with 132 new ETFs launched. Both represent significant increases from 2023.

Prediction 4: Alternative ETFs Will Pick Up Steam

Result: Assets in IMGP DBi Managed Futures Strategy ETF DBMF surpassed $1.3 billion while KFA Mount Lucas Strategy KMLM grew to around $330 million by year-end. The number of non-buffer and non-crypto alternative ETFs available increased to 26 in 2024 from 22 a year prior.

Prediction 5: Covered-Call ETFs Will Lose Steam

Result: ETFs in the derivative income Morningstar Category collected $34.1 billion in new money with overall assets rising to $99.3 billion from $61 billion a year ago.

Prediction 6: ETF Fees Reverse Trend and Increase

Result: The asset-weighted and equal-weighted average fees for all ETFs remained steady at 0.16% and 0.51%, respectively.

Nguồn: https://nullhypothesis.cfd

Danh mục: News