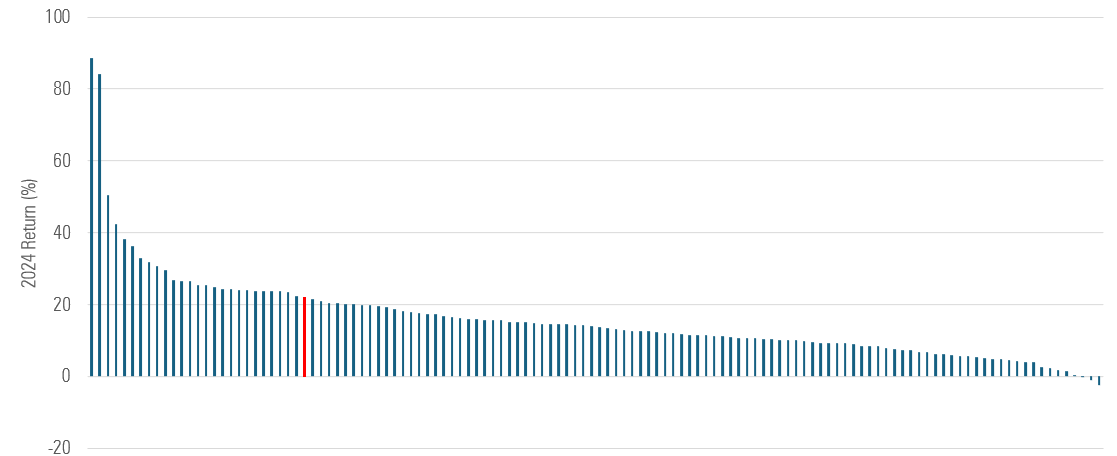

Recent years’ equity mutual fund performance trends trembled in 2024’s fourth quarter but held for the full year. Growth and US stock funds prevailed, while small-cap, value, and non-US vehicles lagged. The Morningstar US Market Index gained 2.6% in the fourth quarter to cap off a historically strong year in which the index rose 24.1%.

Bạn đang xem: Why 2024 Was a Strong Year for Equity Funds

Results for the year varied widely across the nine Morningstar Style Box categories. At one end, the typical large-growth Morningstar Category fund finished atop the group with a 29.0% gain in 2024. At the other end, the typical small-value fund gained just 8.9%.

The ‘Magnificent Seven’ Stocks Lived Up to Their Name

Over the past few years, large-cap technology and consumer stocks such as Nvidia NVDA, Amazon.com AMZN, Microsoft MSFT, and Apple AAPL drove markets to all-time highs. Because of their prominence in large-growth indexes and their strong performance, whether a fund owned them was a good indication as to how it performed relative to its peers, and that trend continued in 2024.

Xem thêm : 3 Invesco Mutual Funds to Add to Your Portfolio

A pair of Alger funds were among the biggest beneficiaries of those companies’ continued dominance. Alger Spectra SPECX and Alger Capital Appreciation ACAAX—managed by Patrick Kelly and Ankur Crawford—gained nearly 50% each in 2024 and topped 98% of their large-growth category peers. The funds’ healthy allocations to Nvidia and AppLovin APP, which gained 171% and 713%, respectively, boosted performance. The funds also owned GLP-1 drug manufacturer Eli Lilly LLY and Amazon, which were also among the top-performing holdings. Conversely, funds that didn’t own or were underweight these highflyers, such as Calvert Equity CSIEX and MFS Intrinsic Value UIVRX, underperformed.

A Weird Year for Active Mid-Growth Managers

The Russell Midcap Growth Index proved to be a tough measuring stick for many actively managed mid-growth funds in 2024. Of the 123 actively managed funds in the mid-growth category, just 26 beat that yardstick. This was due in part to the strong performance of speculative growth names, such as Palantir PLTR and Coinbase COIN, and companies with lofty valuations, such as AppLovin, The Trade Desk TTD, and Axon Enterprise AXON, that many active managers didn’t own.

The managers who did own some of those aggressive growth stocks flourished, though. Morgan Stanley Institutional Growth MSEQX was among the best-performing mid-growth funds in 2024. The fund’s 46.6% gain beat 97% of its peers. Speculative growth names such as MicroStrategy MSTR and Coinbase gained 359% and 43%, respectively, and were among the top contributors to the strategy’s performance. The fund also owned Tesla TSLA, which gained 63% in 2024 and received a huge postelection boost after its CEO Elon Musk was appointed co-head of the proposed Department of Government Efficiency. Alger Mid Cap Focus AFOZX also benefited from owning AppLovin and Palantir since mid-2024.

Small-Value Stocks Continued to Underperform

Small-value was the worst-performing of the nine Morningstar Style Box categories. On average, the group gained just 0.1% in the fourth quarter but ended the year up 8.9%. Deeper-value funds such as Pzena Small Cap Value PZISX tended to underperform. The fund’s 2.0% gain in 2024 trailed 96% of its small-value peers. Longtime holdings Jeld-Wen JELD, TrueBlue TBI, Orion OEC, and Hooker Furnishings HOFT all fell more than 40% this year.

Xem thêm : Understanding the best large-cap mutual funds

Towle Value’s TDVFX 9.0% decline in 2024 trailed all its small-value peers. It too held Jeld-Wen and owned Par Pacific Holdings PARR, Cleveland-Cliffs CLF (which has been caught up in the Nippon Steel takeover talks with US Steel), and Adient ADNT, which all fell more than 50%.

US Stakes Helped a Few International Funds

International stocks had a rough end to the year. The Morningstar Developed Markets ex-USA Index fell 7.5% in 2024’s fourth quarter but finished the year with a 4.4% gain. Emerging-markets stocks fared similarly; the Morningstar Emerging Markets Index fell 7.9% in the fourth quarter but closed the year up 7.1%.

Despite a choppy year for China stocks, the Morningstar China Index rose 16.5% in 2024 and was among the better-performing countries. UK, India, and Germany also finished the year with positive returns, while Brazil was among the worst-performing countries with a 28.4% decline.

John Hancock International Dynamic Growth’s JIJRX exposure to US firms gave it a boost in 2024. As of October 2024, the portfolio owned US tech firms such as Nvidia and Meta Platforms META, which many foreign peers did not own. The fund’s 25.1% gain topped 98% of its foreign large-growth category peers.

What About Emerging Markets?

Emerging-markets funds barely edged their developed-markets ex-US peers. Ashmore Emerging Markets Frontier Equity EFEIX was among the best-performing funds in the diversified emerging-markets category. Its 24.1% gain in 2024 was fueled by top 10 holdings such as Banca Transilvania, Emaar Properties, and FPT Corp, all of which gained more than 25% for the year. PGIM Jennison Emerging Markets Equity Opportunities PDEZX finished just behind it, gaining 18.5% in 2024. Its stake in Taiwan Semiconductor Manufacturing TSM gained 92% over the year, while its second-largest holding as of November 2024, MakeMyTrip MMYT, gained 139%.

Nguồn: https://nullhypothesis.cfd

Danh mục: News