- Is PPSAX a Strong Bond Fund Right Now?

- Is Janus Henderson Triton T (JATTX) a Strong Mutual Fund Pick Right Now?

- Is Fidelity Select Semiconductors (FSELX) a Strong Mutual Fund Pick Right Now?

- “Is Bitcoin overpriced or a bubble? These claims were made at $1,000, $10,000, and no

- Fidelity Investments Canada ULC Announces Estimated 2024 Annual Reinvested Capital Gains Distributions for Fidelity ETFs and ETF Series of Fidelity Mutual Funds Français

- Israel will launch six Bitcoin mutual funds by the end of 2024.

- U.S. Bitcoin ETFs’ success sparks market growth, influencing Israel’s crypto investment landscape.

Amidst nations stepping up their crypto game, Israel is also following suit. As per recent reports, Israel is set to launch six mutual funds tied to Bitcoin [BTC]‘s performance on the 31st of December.

This initiative marks a key step in bringing cryptocurrencies into mainstream investments. Furthermore, it highlights their growing acceptance in Israel’s financial market.

All about Israel’s Bitcoin mutual funds

Licensed by the Israel Securities Authority (ISA) last week, the new mutual funds offer investors the opportunity to access Bitcoin investments directly through Israel’s local currency, the shekel.

Xem thêm : Western Asset Mutual Fund Investors That Suffered Losses

These funds will enable investors to purchase units at the prevailing market price of Bitcoin. In addition, transactions will be processed once daily when orders are placed.

The newly approved mutual funds in Israel aim to track Bitcoin’s price using diverse strategies, including index-based and active management approaches.

Notably, some of these funds will also integrate the performance of prominent U.S. Bitcoin ETFs, such as BlackRock’s iShares Bitcoin Trust ETF (IBIT).

Among these offerings, one fund is specifically designed to outperform Bitcoin’s returns through active management.

This development follows the Israel Securities Authority’s approval earlier this month, with IBI and More being among the firms authorized to launch these innovative products.

How was the U.S. the torchbearer for Israel?

Needless to say, the introduction of Bitcoin mutual funds in Israel follows nearly a year after the U.S. witnessed the debut of spot-based Bitcoin ETFs.

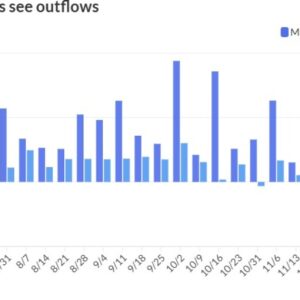

As anticipated, these ETFs have seen remarkable success, amassing $110 billion in net assets. BlackRock’s iShares Bitcoin Trust ETF alone accounts for nearly $54 billion, according to SoSoValue.

Xem thêm : Canoe Financial announces an estimated special non-cash

This success has not gone unnoticed by industry leaders, with many attributing BTC’s price milestones to the substantial institutional interest driven by the ETFs.

Hence, remarking on the same, Eyal Goren, deputy CEO of IBI Funds, noted that ETFs played a pivotal role in pushing BTC’s price past the $100,000 mark.

Goren said,

“It is impossible to argue that the SEC’s approval was one of the reasons that pushed the price of Bitcoin up. As soon as they started making the product available to the public, it changed the game. As of today, most Bitcoins are in certificates and not in digital wallet.”

However, while this marks a significant advancement for Israel’s financial market, local industry leaders have expressed frustration over the timing.

They argued that earlier approval could have allowed investors to capitalize on Bitcoin’s recent price rally.

Despite this, Israel’s move signals promising growth for cryptocurrency adoption in the region.

Nguồn: https://nullhypothesis.cfd

Danh mục: News