- Fidelity Investments Canada ULC Announces Estimated December 2024 Cash Distributions for Fidelity ETFs and ETF Series of Fidelity Mutual Funds

- Best China Region Mutual Funds in 2024

- Is VTIPX a Strong Bond Fund Right Now?

- 5 Best Mutual Funds To Buy In 2025

- How to review your mutual fund investment portfolio in 2025

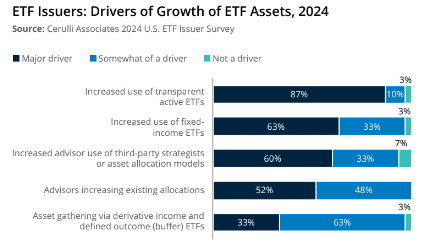

Nearly all exchange-traded fund issuers are developing or planning to develop a transparent active ETF product according to Cerulli Associates, the fund data provider.

Bạn đang xem: Active ETFs and Fixed Income to Drive Flows

Cerulli said in a report that 91% of ETF issuers are developing or planning to develop a transparent active ETF product, versus 26% for passive ETFs. The report said: “Fee compression in passive ETFs and greater acceptance of active ETF product has made active ETFs the predominant focus.”

Source: Cerulli

ETF assets under management exceeded $10 trillion for the first time in November 2024 according to Cerulli.

“The vehicle crushed its previous monthly flow record, totaling $156bn,” said Cerulli. “As of the end of November, active ETFs nearly doubled their total net inflows posted in 2023.”

This increased in December 2024 when Oakmark and MFS Investment Management both entered the active ETF market. Asset management research provider Morningstar said MFS, which launched the US’ first mutual fund more than 100 years ago, introduced its first series of actively managed ETFs with three equity and two fixed-income active funds.

Michael Roberge, MFS

Michael Roberge, then chief executive and chair of MFS, said in a statement that the ETFs allow investors to access MFS’ investment capabilities across five popular investment categories. He said: “As investors’ needs become more diverse and complex, we are pleased to be able to offer this next level of vehicle choice.”

The funds also marked Harris Associates’ first foray into ETFs and the first ETF it listed under the Oakmark brand according to Morningstar.

Cerulli also expects ETFs to be used to provide access to a broader range of alternative investment exposures, including private capital. In 2019 commodities and real estate ETFs made up two thirds, 65%, of what Cerulli defines as alternative category ETFs. By the second quarter of 2024 that had decreased to about 37%, due to the increase in ETFs providing derivative income, defined outcome, and cryptocurrency exposures according to The Cerulli Report—U.S. Exchange-Traded Fund Markets 2024.

Alternative ETF assets crossed $400bn in net assets in November 2024 and had asset growth rate of 93% in the first 11 months of the year, highest among all asset classes, according to Cerulli.

“Rapidly, the alternative investment offerings in the ETF structure have shifted from simple passive holdings to more active strategies that provide advisors with specific outcomes such as greater income and predefined return profiles,” added Cerulli.

However, there are challenges. About half of advisors do not use alternative investments exposures due to concerns about liquidity, heightened fees, product complexity, and burdensome subscription/redemption processes according to Cerulli.

Daniil Shapiro, director of Cerulli, said in the report: “While not a perfect replacement to illiquid private capital exposures, an ETF could be exactly the thing for a cohort of financial advisors looking to initiate use of true alternative investments exposures with greater operational ease.”

BlackRock and State Street Global Advisors announced initiatives in 2024 to widen investor access to private markets.

State Street Global Advisors, the asset management arm of State Street, and Apollo Global Management, an alternative assets and retirement solutions provider, have filed to launch an actively managed exchange-traded fund that invests in public and private credit in one ETF portfolio. Morningstar described the SPDR SSGA Apollo IG Public and Private Credit ETF as the “first ETF of its kind” as it intends to directly hold private credit.

Anna Paglia, State Street Global Advisors

Morningstar said in a report: “However, there are several issues with this proposed ETF, all of which boil down to the fact that one firm (Apollo) appears to be the valuation provider, originator, buyer, and seller of the fund’s private credit investments, which may constitute the bulk of this ETF’s portfolio. The ball is now in the SEC’s court.”

Anna Paglia, chief business officer at State Street Global Advisors, said in a statement that demand for private assets is expected to continue to grow in the coming decade, but they have only mainly been open to large institutions and ultra-high net worth investors. As a result, State Street Global Advisors will be working with Apollo to democratize access to private asset exposures through exchange-traded funds and other investment products

“It is our goal to bring these investments to scale and help facilitate the process of making private assets more accessible and liquid over time,” added Paglia. “We see this as only the beginning of a new wave of innovation as public and private markets increasingly converge.”

BlackRock and Partners Group have partnered to launch a multi-private markets models solution by providing access to private equity, private credit and real assets in a single portfolio which is not currently available to the U.S. wealth market.

Xem thêm : Investors got richer by Rs 17 bn, experts say trend will continue in 2025 – Firstpost

Larry Fink, BlackRock

Larry Fink, chairman and chief executive of BlackRock, has said he believes the asset manager can lead the indexing of private markets, in the same way that indexing has become the language of public markets.

When BlackRock announced the acquisition of Preqin, an independent provider of private markets data, in June 2024 Fink said on a conference call that the deal is about driving evolution and growth in private markets by measuring them, understanding their drivers of performance and making them more investable.

“We envision we can bring the principles of indexing, and even iShares [BlackRock’s exchange-traded funds business], to the private markets,” he added. “We anticipate indexes and data will be important future drivers of the democratisation of all alternatives, and this acquisition is the unlock.”

Institutional investors increasingly use ETFs

In addition, 37% of institutions expect to increase allocations to ETFs over the next two years according to The Cerulli Report—North American Institutional Markets 2024. This trend was strongest among insurance general accounts,, with a net 40% expecting to increase allocations to ETFs and a net 25% expecting to decrease allocations to mutual funds.

Four fifths, 80%, of institutional investors surveyed by Cerulli report use ETFs. The most common uses are to gain or maintain exposures (51%), manage cash/liquidity (34%), and/or make tactical bets (27%).

Jack Tamposi, associate director at Cerulli, said in the report: “Institutions indicate that they use the vehicle as a transition tool, managing exposures to asset classes, rather than as a long-term, core investment holding.”

However, as institutions continue to look for ways to reduce costs and also allocate their risk budgets to esoteric strategies such as private markets, Cerulli expects more institutions will use ETFs as long-term holdings.

Nguồn: https://nullhypothesis.cfd

Danh mục: News