- Best Year-End Picks: These value mutual funds gave over 25% return in the past year. Do you own any?

- Lost track of inactive mutual funds? Sebi plans search platform

- Six Bitcoin funds set to debut in Israel following regulatory approval

- 3 Mid-Cap Blend Mutual Funds for Stellar Returns

- Alger Spectra Fund Q3 2024 Commentary (Mutual Fund:SPECX)

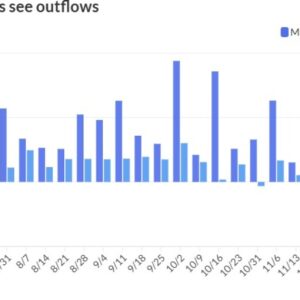

Assets under management (AUM) of these schemes rose to ₹4.51 lakh crore in November 2024 from ₹2.28 lakh crore in November 2023. During the period, fund houses launched 45 new plans, taking the total number of schemes to 190.

Bạn đang xem: mutual funds: MFs court investors with new themes; wealth managers advise small exposure

Wealth managers ask investors to have a core portfolio in place first and add 10-15% of their portfolio to thematic funds.

Xem thêm : Edward Jones, Osaic, and Cambridge repaying $8.2M in mutual fund charges to clients

Distributors point out there has been a high flow into these schemes through new fund offers (NFOs). New funds generate a lot of interest amongst retail investors due to high decibel marketing. Since fund houses can launch only one mutual fund scheme in each category, and large fund houses already have a product in popular categories, they are now launching thematic funds.

“Fund houses, restricted from launching multiple schemes in a single category, have turned to thematic funds, focusing on areas like manufacturing, business cycles, and innovation,” says Amar Ranu, head – investment insights, Anand Rathi Share and Stock Brokers.Ranu points out that high past returns from these themes and aggressive marketing push by asset managers is driving sales in this category.Some of the large new fund offers in the thematic space over the last one year have been from the likes of SBI Energy Opportunities Fund, HDFC Manufacturing Fund, SBI Innovation Fund, ICICI Prudential Energy Opportunities Fund, Motilal Oswal Defence Index Fund, Axis Manufacturing Fund, Kotak MNC and Kotak Special Opportunities Fund.

Conversations around renewable energy, clean energy, green hydrogen have attracted investors to energy opportunities funds, while the large runaway for growth for innovation in areas like quick commerce, pharma and telecom has led to flows into innovation funds.

The China-plus-one strategy, focus on PLI scheme is attracting investors to the manufacturing segment.

Xem thêm : Best Roth IRA Accounts for December 2024

Wealth managers caution investors over the narrow mandates of many thematic funds and the higher risk they carry when compared to diversified funds. For example, the real estate index fund has only 10 stocks in its portfolio, leading to high concentration risk as well. “These funds often come with higher costs and require careful due diligence. Investors should understand the risks before adding them to their portfolio” adds Ranu.

First-time investors should avoid getting into thematic funds.

“Investors should first build a core portfolio of diversified equity mutual funds and then make a small satellite allocation to sectoral and thematic funds which they expect to do well over the next 2-3 years,” says Dheeraj Gaur, CEO, Spark Capital.

Gaur recommends investors to have an allocation of 10-15% of their equity portfolio to such funds.

Nguồn: https://nullhypothesis.cfd

Danh mục: News