The Israel Securities Authority (ISA) just approved six Bitcoin mutual funds, all set to roll out on December 31. This is the first time Israeli investors will have access to Bitcoin-focused mutual funds.

Bạn đang xem: Israel approves six Bitcoin mutual funds, launching December 31

The funds, offered by Migdal Capital Markets, More, Ayalon, Phoenix Investment, Meitav, and IBI, will all go live at once, per a condition from regulators. Management fees are set between 0.25% and 1.5%, with one fund standing out by actively managing its portfolio to beat Bitcoin’s market performance.

For now, transactions will be limited to once a day, although future funds may allow continuous trading.

Regulators finally loosen the reins

Investment firms have been begging for this moment for over a year. “The investment houses have been pleading for more than a year for ETFs to be approved and started sending prospectuses for Bitcoin funds in the middle of the year.

Xem thêm : Lazard US Small Cap Equity Select Portfolio Q3 2024 Commentary (Mutual Fund:LZCOX)

But the regulator marches to its own tune. It has to check the details,” an anonymous investment executive told Calcalist. This follows in the footsteps of the U.S., where the SEC approved spot Bitcoin ETFs last January.

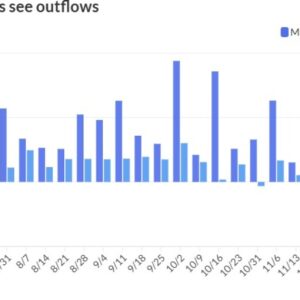

Those funds have attracted $35.6 billion in capital while Bitcoin’s value has doubled, making over five new all-time highs this year.

Israel’s crypto industry has been bubbling under the surface for years. The so-called “Start-Up Nation” is home to around 174 crypto-focused companies employing 3,800 people, covering areas like blockchain development and algorithmic trading.

Despite the innovation, regulatory bottlenecks have held the market back. Israeli banks are still highly skeptical of crypto transactions, citing fears of money laundering and compliance issues.

Many banks won’t even process funds derived from crypto, making it a nightmare for investors to comply with tax regulations. The Israel Tax Authority (ITA) introduced a temporary measure in January to allow taxpayers to report crypto profits through special accounts.

Xem thêm : Western Asset Mutual Fund Investors That Suffered Losses

That measure has been extended until December 31, but it’s a band-aid for a much bigger problem. Alongside Bitcoin mutual funds, Israel has also gotten into Central Bank Digital Currencies (CBDCs).

The Bank of Israel has been working on a digital shekel, releasing an architecture paper earlier this year and launching a test environment in May. Economically, Israel is on solid ground.

The country posted a $4.96 billion current account surplus in Q2 2024, thanks to strong exports and investment inflows. Analysts predict the surplus could grow to $7.8 billion by the end of the year.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Nguồn: https://nullhypothesis.cfd

Danh mục: News