- India Loosens Rules For Passive Mutual Funds With New SEBI Guidelines

- “Is Bitcoin overpriced or a bubble? These claims were made at $1,000, $10,000, and no

- Elon Musk Adjusts Ambitious $2 Trillion Budget Cut Plan

- How the Largest Bond Funds Did in 2024

- Israel Launches Six Bitcoin Mutual Funds for Regulated Investments

Major U.S. indices continued their northbound journey after a solid rebound in 2024. However, uncertainties remain over Donald Trump’s economic policies, the Federal Reserve’s interest rate cut in 2025 and labor market conditions.

Bạn đang xem: 3 Top Vanguard Mutual Funds to Accumulate for Gains in 2025

Especially at a time when the Fed expects inflation to remain under check, Trump’s popular policies like the reduction of corporate tax, deregulation and imposition of tariffs on foreign products are expected to boost economic growth but can also spike inflation rates. Currently, the Fed fund rate is in the range of 4.25-4.5%. The Fed is anticipated to implement two 25 basis points rate cuts in 2025 instead of four indicated in September.

According to the Institute of Supply Management reports, the manufacturing Purchasing Managers’ Index (PMI) contracted for the ninth consecutive month in December to 49.3 against the consensus estimate of 48. However, services PMI came in at 54.1 for December, beating the consensus estimate of 53.4. Any reading below 50 indicates a contraction of manufacturing activities. U.S. job openings unexpectedly increased by 259,000 to 8.098 million in November, but a softening in hiring by 125,000 pointed to a slowing labor market. The Job Openings and Labor Turnover Survey (JOLTS) report indicates that there were 1.13 job openings for every unemployed person in November, up from 1.12 in October.

In such a situation, mutual fund investing can help those who wish to diversify their portfolio among various asset classes but lack professional expertise in managing funds. Vanguard mutual funds like Vanguard Energy VGENX, Vanguard Selected Value VASVX and Vanguard Growth and Income Fund VQNPX should be good choices since they provide low-cost, uncomplicated equity, fixed-income and multi-asset funds that can help investors meet their goals.

These funds have wide exposure in sectors like finance, industrial cyclical, technology, retail trade, non-durable, and health since they have given a positive return and are expected to perform well in the near future.

Vanguard, one of the world’s largest asset management corporations, was founded by John C. Bogle on May 1, 1975. Headquartered in Vally Forge, PN, the company had $10.1 trillion in assets under management globally till Sept. 30, 2024. Vanguard had more than 20,000 employees worldwide and offered 212 funds in the United States and 216 in foreign markets to about 50 million investors as of Dec. 31, 2023.

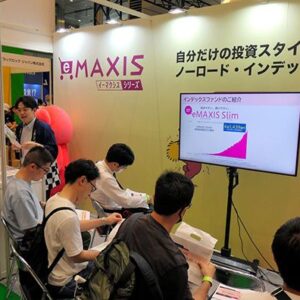

Vanguard is owned entirely by funds, a unique feature among mutual fund firms. According to the company, this structure allows management to focus more on shareholder interests. Among the most significant advantages, Vanguard claims to offer low-cost, no-load funds. This means that the fund doesn’t charge investors when fund shares are being bought or sold.

Nguồn: https://nullhypothesis.cfd

Danh mục: News