- Best corporate bond mutual funds to invest in December 2024

- New next-day stock delivery will come at a cost: Know how T+0 settlement will impact mutual fund and stock investors

- A Closer Look at Parnassus Investments’ 2 New Active ETFs

- Several Bitcoin Mutual Funds to Go Live in Israel

- Specialised investment funds: Sebi sets ₹10 lakh minimum threshold for investors

In 2022, economic growth plus Russia’s invasion of Ukraine caused inflation to rear its ugly head. The Federal Reserve responded with an aggressive course of interest-rate hikes, and large-growth funds were woozy, and so were long-term bond funds because they are very sensitive to interest-rate changes, for good and bad.

Bạn đang xem: How to Diversify Away From Large-Growth Funds

T. Rowe Price Growth Stock PRGFX and Baron Global Advantage BGAFX were hit hard. They finished the year down 40% and 52%, respectively. Long-term Treasury funds were down almost as much.

But Vanguard Energy VGENX was quite happy, as was Hotchkis & Wiley Small Cap Value HWSIX. Naturally, energy and other deep-value stocks were in the black. Those funds gained 24% and 4%, respectively. Alternative funds, which can bet on commodities, also enjoyed their day in the sun. Virtus AlphaSimplex Managed Futures Strategy AMFAX gained 35%, and BlackRock Tactical Opportunities PCBAX was up about 6%.

Bank-loan and short-term bond funds mostly finished flat or down less than 1%.

Clearly, diversification can help temper the pain when parts of the market get crushed.

It’s not a coincidence that growth’s correction came two years after a blowout rally in 2020 when many growth funds gained 50% or more. Growth is a volatile but absolutely vital space that you should stick with. That brings us to 2024: Growth is enjoying another great year as weight-loss drugs and artificial intelligence are spurring a huge boom for the asset class. Most growth funds are up well over 20% for the year to date.

The next growth correction could come in 2025 or 2029. If you don’t rebalance often, you might have a lot in growth. Rather than dump it entirely, it makes sense to shift some of those growth assets into areas that often hold their value better when growth is crashing. Let’s look at which Morningstar Categories held up best in past growth corrections.

We’ve had five big growth selloffs as judged by calendar years in this century: 2000, 2001, 2002, 2008, and 2022. I looked to see which categories did the best in those years. Not one had positive returns in all five, but some suffered minimal losses or had gains in four of the five years in question.

Xem thêm : World’s Biggest Solo Stock-Picker Is Having Best Year Since 1991

Naturally, short-term high-quality bond funds (and cash) are the most reliable bulwarks against almost any maelstrom. The short-term bond category averaged a 2.2% return over those growth selloff periods, but it did lose 5.2% in 2022. Short-term inflation-protected bond funds averaged a 3.1% return but lost 4.9% in 2022. Financial planners recommend holding six to 12 months’ salary in money markets and short-term bond funds as a rainy-day fund in case you lose your job or have a surprise bill, but that money also serves to reduce bear-market pain.

On the other hand, short-term bonds have low returns and can lag inflation, especially when it bounces.

The best average return during tough periods for growth stocks belongs to long-term government funds. The category returned an average of 6.5% annualized across the five years in question. It’s easy to see why it usually has a low correlation with large-growth funds. Economic recessions are poison for growth but a real boon to long-term government bonds as interest rates and inflation come tumbling down. That’s typical of many growth corrections, except the one in 2022 when surging interest rates caused valuation contraction in growth stocks at the same time they took long-term bonds to the woodshed. Long-term government funds lost a whopping 30% in 2022—a painful reminder that even “safe” assets have their risks.

So, the long government category is a very nice diversifier, but it packs plenty of interest-rate risk, so I wouldn’t load up on the stuff.

Let’s look between short and long to see how intermediate-bond funds did. The intermediate government category averaged 4.1%, while intermediate core bond and intermediate core-plus bond funds had modest 1.4% and 1.9% gains, respectively. It’s nice to see that your core bond holdings will hold strong when equities are cracking up. All three lost between 11% and 13% in 2022, and that figures to be close to the worst-case scenario.

When you buy most taxable-bond funds, you are getting some corporate bonds in the mix, so there is some overlap with stocks and the economy. Municipal bonds, however, have minimal corporate exposure and have fewer defaults because they are issued by entities like city and state governments that endure and, of course, can tax to pay debt. Intermediate munis averaged a 2.3% gain in growth down markets.

What about equities? Although the rest of the equity world usually loses money when large growth does, some areas have held up pretty well. For perspective, large growth lost 26.7% on average during the periods in question.

Small value, for example, lost only 3.6% on average, and it logged gains in two of those years. When large growth goes on a big rally, it tends to take all the oxygen out of small value, leaving that corner of the Morningstar Style Box very cheap and pretty well protected against a selloff.

Mid-cap value lost 6.6% on average, and large value lost 11.8% on average. Oddly enough, foreign equities didn’t provide as much diversification. The foreign small/mid-value category shed 16.6% on average, and foreign small/mid-blend dropped 17.9%. Foreign large blend dropped 22.9%, and foreign large value declined 17.3%. Emerging markets seem to move in sync with large growth much of the time, hence that category’s 23.1% loss.

Xem thêm : Best banking & PSU mutual funds to invest in December 2024

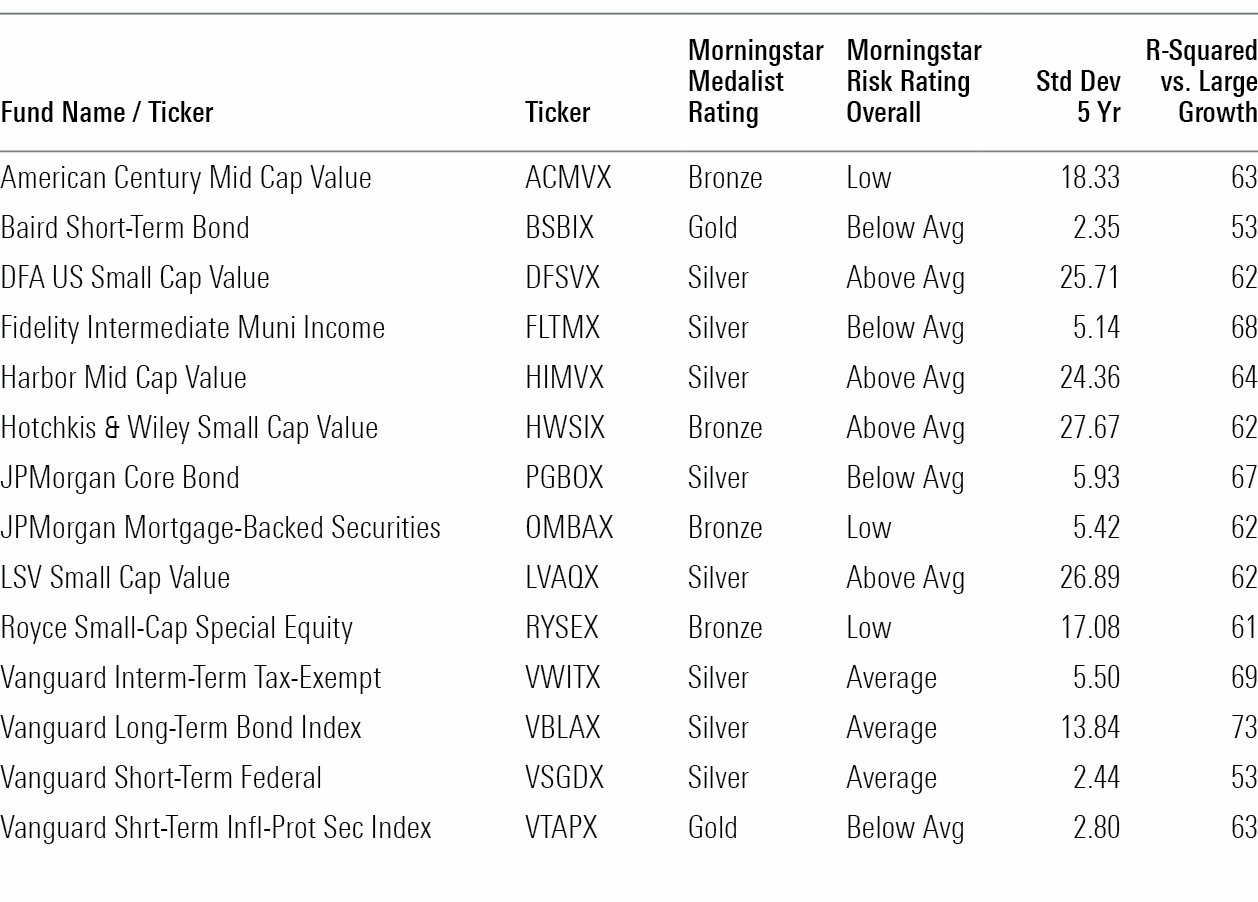

So, which specific funds work best? I went through each category and ran correlation figures against strategies with Morningstar Medalist Ratings of Gold, Silver, or Bronze to find some that have not been in sync with large growth. (Specifically, I tested versus Vanguard Growth Index VIGAX over the three years through Sept. 24, 2024.) I also looked at risk measures like downside capture and risk relative to peers to give you some sense of general defensive properties.

Short-Term Bonds

Vanguard Short-Term Federal VSGDX and Baird Short-Term Bond BSBIX had low R-squared figures of 53 versus large growth. (An R-squared figure of 100 means perfectly in sync and 0 means no correlation at all.) Both have low credit and interest-rate risk, so they serve as diversifiers as well as excellent vehicles for short-term needs in general, such as security for losing your job or having a big surprise expense. Also, they work nicely for retired investors as they move assets from higher-risk assets to lower-risk assets that they plan to spend in the near term.

I also like Vanguard Short-Term Inflation-Protected Securities Index VTAPX, which had an R-squared of 63 versus large growth. You may recall that the 2022 growth selloff came because of a spike in interest rates, which itself was triggered by a surge in inflation. The tricky part about Treasury Inflation-Protected Securities is that their face value adjusts for inflation, but they come with low coupons compared with nominal Treasuries that amplify interest-rate risks, especially those with long maturities. So, longer-term TIPS lost a fair amount of value in 2022 because their inflation adjustments didn’t make up all the ground they lost on interest rates. That’s why I like short-term TIPS funds like this one.

Long Bonds

In 2022, long bonds were a bad spot because of rising rates, but more often we see bear markets happen because of a recession or the anticipation of one. In those cases, long-term, high-quality bonds do wonderfully. They’re less defensive than short-term bond funds, but the central idea of diversification is that different asset classes work in different environments. Vanguard Long-Term Bond Index VBLAX had a 73 R-squared versus large growth. I wouldn’t put a big part of my portfolio here because of interest-rate risk, but I like long bonds as small positions that can zig when others zag.

Intermediate Core Bonds

JPMorgan Mortgage-Backed Securities OMBAX had the lowest R-squared among intermediate-bond funds with a figure of just 62. Next was JPMorgan Core Bond PGBOX at 67. Both funds lost less than most of their peers in the 2022 meltdown because they have a focus on asset-backed securities that have positively convex features. That’s bondspeak for bonds that are not only more resilient in the face of rising interest rates but also do well when rates fall.

Muni Intermediate

Fidelity Intermediate Municipal Income FLTMX and Vanguard Intermediate-Term Tax-Exempt VWITX clocked in with R-squareds of 68 and 69, respectively. Both are very dependable low-fee, high-quality funds.

Small Value

Royce Small-Cap Special Equity RYSEX had the category’s lowest R-squared versus large growth at 61. This is the sort of fund that I love as a diversifier. It’s defensive, and its accounting emphasis gives it an edge unlike any other fund. We had the management trio in the offices (and via Zoom) recently, and I was happy to see that the firm has a younger generation of managers who very much believe in Charlie Dreifus’ approach. Steven McBoyle and Tim Hipskind figure to keep this fund true to Dreifus’ vision whenever he steps down. I own this one in my 401(k).

A trio of deep-value small-cap funds had R-squareds of 62. I view each as more volatile than the Royce fund, but they do serve as diversifiers by investing in very cheap and small stocks. They are DFA US Small Cap Value DFSVX, LSV Small Cap Value LVAQX, and Hotchkis & Wiley Small Cap Value HWSIX.

Mid-Value

American Century Mid Cap Value ACMVX and Harbor Mid Cap Value HIMVX came in with low R-squareds of 63 and 64, respectively. They stay grounded in value stocks so that they hold up well in growth declines, though it also means recent results are unexciting. American Century Mid-Cap Value looks for durable businesses with competitive advantages, but its managers insist that their stocks be cheap, too, so they must sift through a lot of companies to find names that tick all the boxes. Harbor Mid Cap Value is subadvised by the same deep-value quants who run LSV, so no surprise that their mid-cap fund did similar things.

This article first appeared in the November 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by https://www.morningstar.com/lp/mfi-sample-issue.

Nguồn: https://nullhypothesis.cfd

Danh mục: News